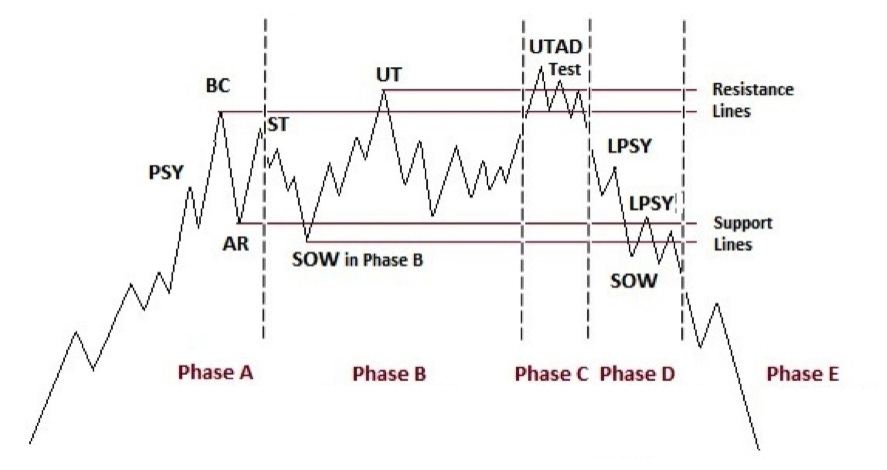

Bitcoin. Are We Seeing A Wyckoff Distribution?

Here's my shorter term view on the cryptocurrency.

Bitcoin is doing it’s usual thing of ranging for a very long time.

While bulls and bears fight on Twitter with their opinions, it’s possible we may be seeing the start of a Wyckoff distribution.

Let’s look at the 4 hour chart in detail.

When a market ranges for a long period of time, it is inevitable that stops are building on both sides of the range. It would not surprise me at all if the highs were spiked again and early shorts were taken out.

After that, we may see some further ranging around that Price Pivot Zone.

In order for a bearish move to continue, we want to see:

The market holding below that Price Pivot Zone.

The major support level taken out. By this, I mean not just a spike, but a fast impulsive dump and hold the level. Conservative traders could then sell a retest of prior support (becoming resistance).

Further levels to the downside, where we may see bounces are 25080 Demand, 22700 PPZ and Demand.

Now, assuming we get that spike of stops to the upside and major support is broken and retested, we’ll get the classic Wyckoff Distribution pattern.

Visit TraderSimon.com to learn my proprietary trading strategies and a 25% discount until midnight Monday 10th April, using code EASTER25.

I can see the UT looking for the spike to take the stops out and grab the liquidity