✍️ New Year's Strategy Special 29th Dec - 3rd January

Celebrating the trades which we "knocked out the park", plus a special look at trading strategy and my top 5 Crypto picks for 2025.

Celebrating This Year’s Successes!

Most of the time, trading consists of regular sized wins and losses, but every so often a trade will come along where you can truly say “you knocked it out of the park”.

Here’s some of those winning trades that we took this year.

Copper

Not strictly this year, but called one week before!

This swing long on Copper was called at Christmas last year. The basic premise behind the Setup was price retesting the top of the Bull Channel after it had spiked the swing low (red line).

Here’s how that looked on a weekly chart.

And here’s how it played out after scaling profit at T1. We added further targets of T2 at the upper Supply Zone and T3 at the major high. The remainder was scaled after the rejection of the high and a subsequent small bounce.

Silver

We also continue to hold heavily scaled Gold and Silver positions from the previous year.

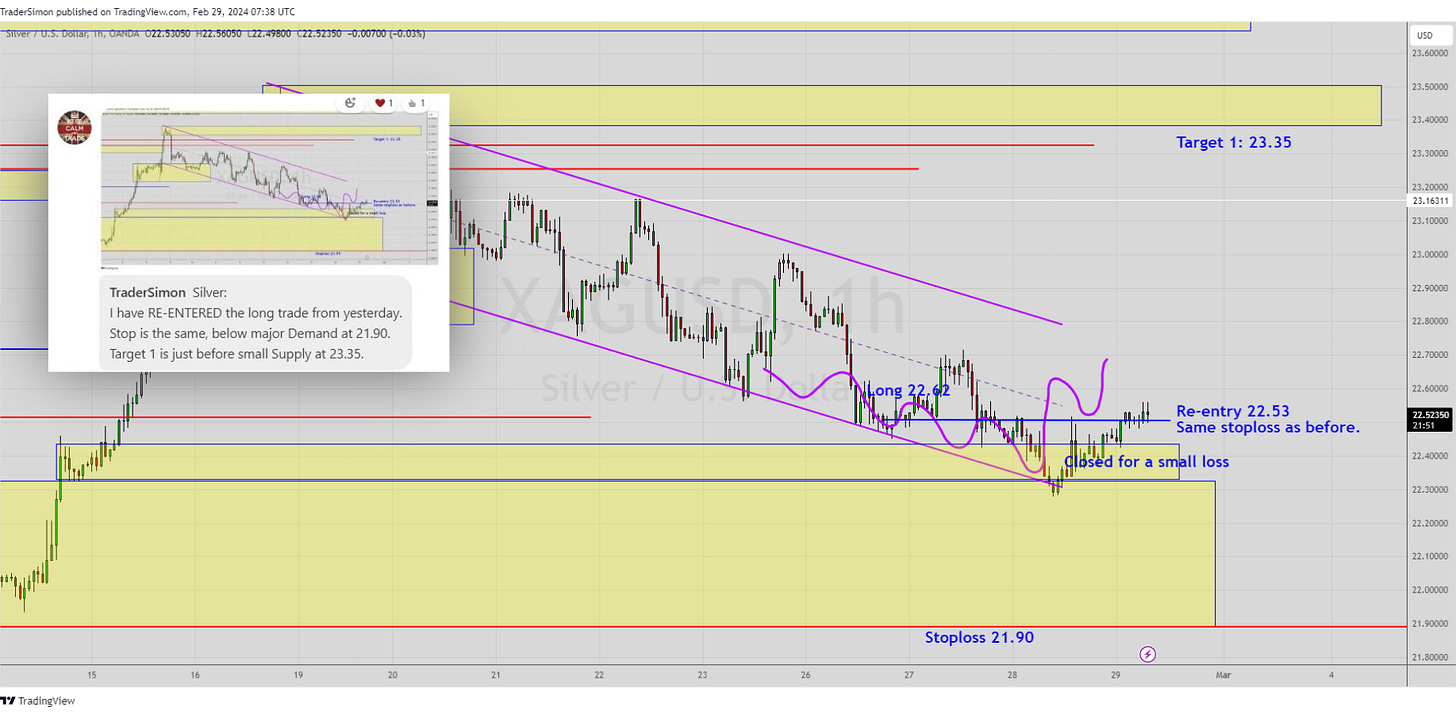

We added a further Silver entry at 22.53 in March this year, with 10% of the trade still running.

This was the moment I called a long on Silver, after scratching a previous attempt.

As with a lot of trades, I scale profit along the way. In this case, profit was taken at 22.97 and 23.24.

A further profit scale was taken at 24.65 as shown on the daily chart below (which also shows last year’s entries).

Incidentally, this is a good way to safely build long term positions, by scaling profits and adding along the way.

S&P 500

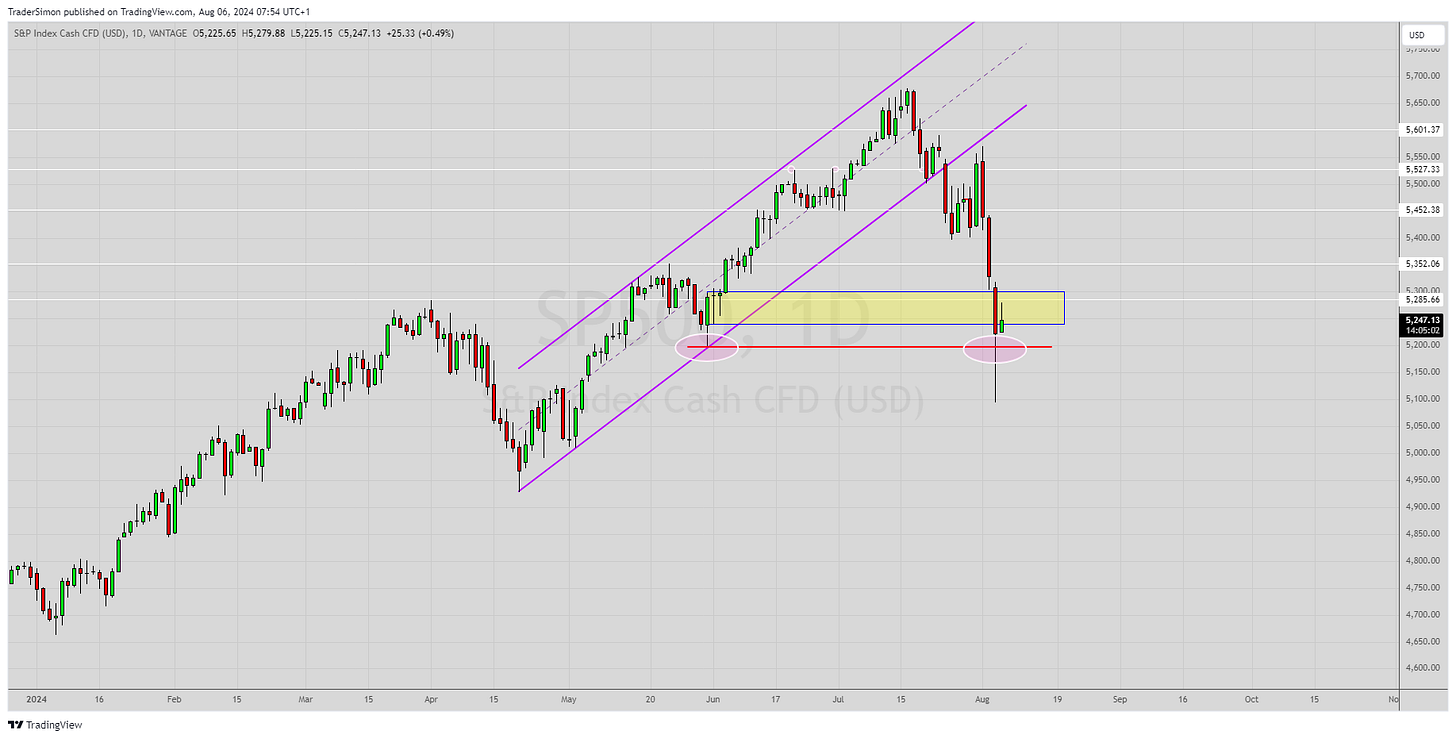

This was a long setup called in August which led to a big rally in the S&P 500.

Price had spiked a major low and made a “V” shaped reversal. This was the entry on a 1 hour chart.

And the higher timeframe reason for the trade was a spike of a major low, as shown on the daily chart below.

One other factor that influenced this trade was that Twitter/X were extremely bearish the S&P at this point in time, i.e. we were looking to fade the mainstream consensus.

Our first profit scale at 5306 was an easy one, as shown on the daily chart below.

Price continued to move up and we scaled further profits at 5396 and 5525, leaving just 10% remaining in the trade.

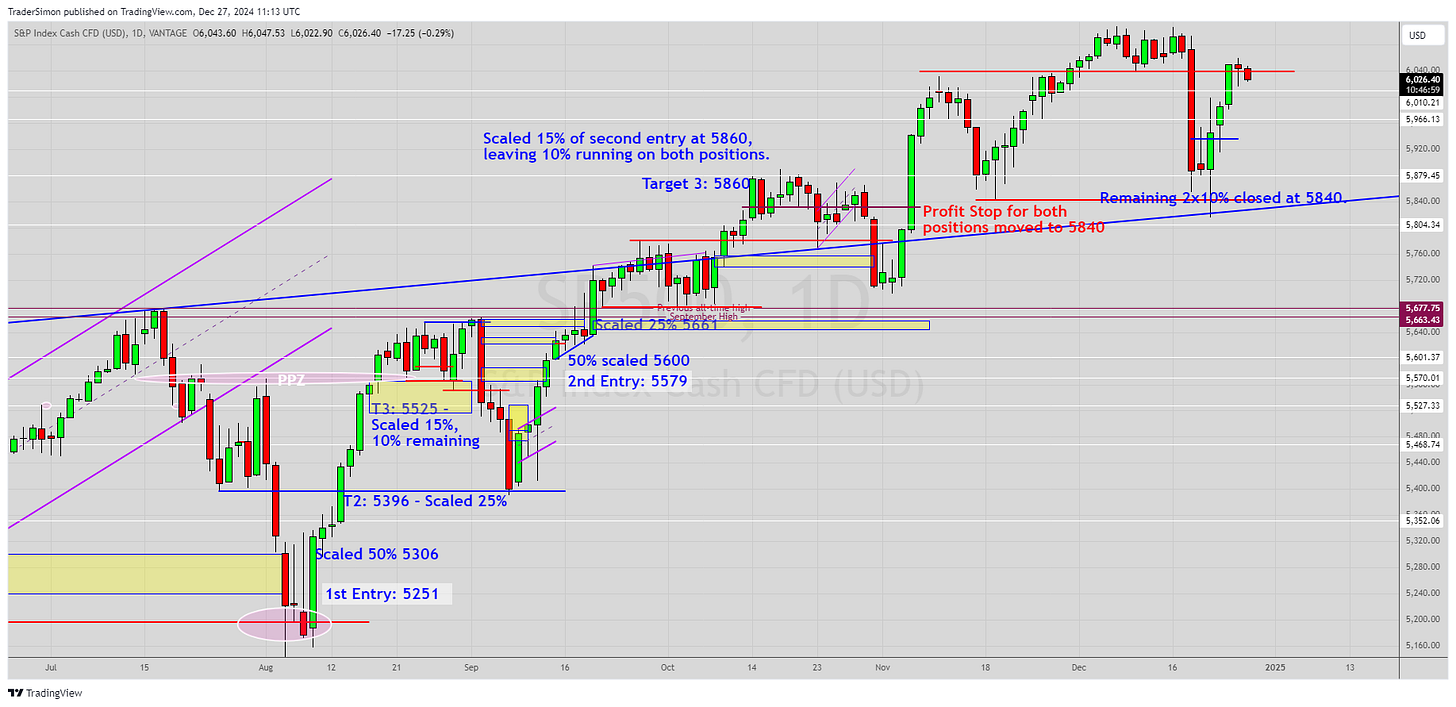

Fast forward to this month and here’s how the chart looks today (excuse the messy chart).

We were finally taken out of the remaining 10% of our position by the profit stop at 5840.

You’ll also notice we entered a second position at 5579. Again, this was scaled along the way at 5600, 5661, 5860 and finally the remainder was taken out at the same profit stop as before.

Bitcoin

In September, I mentioned that Bitcoin looked ready to pump with a target of 90K by the November US election. Here’s the original chart:

…and the daily chart shows where we entered at 61,900.

We took profit, just a touch before the 90K target, after Trump was elected in November and the crypto markets rallied.

We didn’t get a pullback from that level, and you’ll notice the market headed straight to the second target and reacted there.

Dogecoin

We also did very well on Cryptos, Dogecoin being one of many examples.

This is the original Dogecoin setup - the setup was a Descending Wedge into a Price Pivot Zone, and yes my entry was a little bit early!

And here’s how it played out, with profit scales taken along the way.

We took a similar profitable setup on Chainlink and we’ll cover the key concepts behind both these setups in the members section.

As it’s the last newsletter of the year, we’re going to do something different and delve into trading strategy with examples taken from some of this year’s trades. I’ll also give you my top 5 Cryptos that I expect to do well in 2025. This bit is strictly for members, so if you haven’t yet joined, consider doing so! 👇🏼👇🏼👇🏼