✍️ Weekly Trade Plan & Recap 1st - 6th December

How patience paid off on the Euro! Plus analysis for the Dollar Index, EUR/USD, Gold, Silver, S&P 500, Bitcoin, Cardano, Chainlink and how to trade the Memecoin "LOL".

Last Week

It was a quiet week with Thanksgiving, but nonetheless, we managed to walk away with a profit thanks to the Euro.

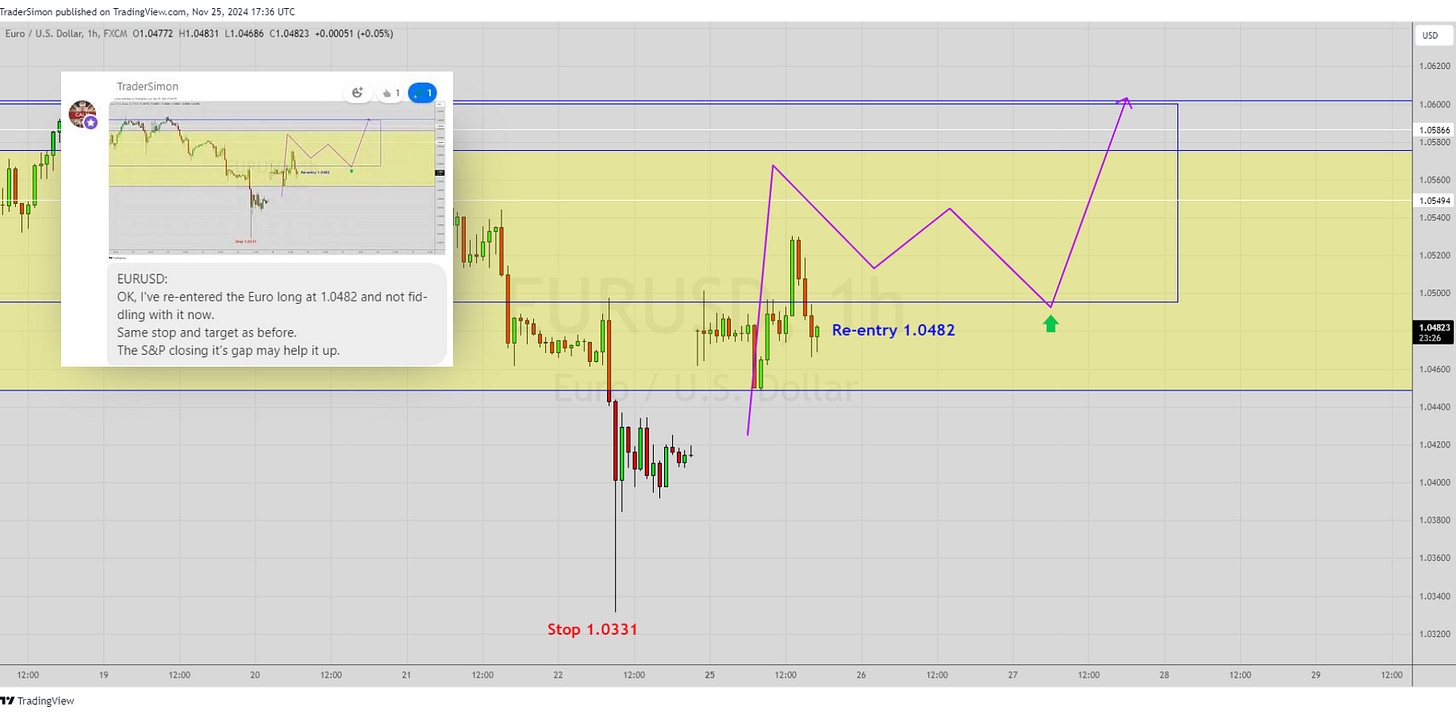

The Euro had spiked a key higher timeframe level, gapped up on the Sunday night open, printed bullish structure and popped back inside the range, so I called a long in the Substack chat.

That first attempt at a long was quickly scratched after price couldn’t hold inside the range.

Realising that my higher timeframe idea for the trade was still valid, price structure was still bullish and the S&P 500 had just closed it’s gap (correlation), I called a re-entry long on the Euro.

The Euro is one of those FX pairs that demands a lot of patience.

So we waited and waited and waited…

On Tuesday, it dropped lower and filled it’s gap (which would have been a better entry in hindsight!).

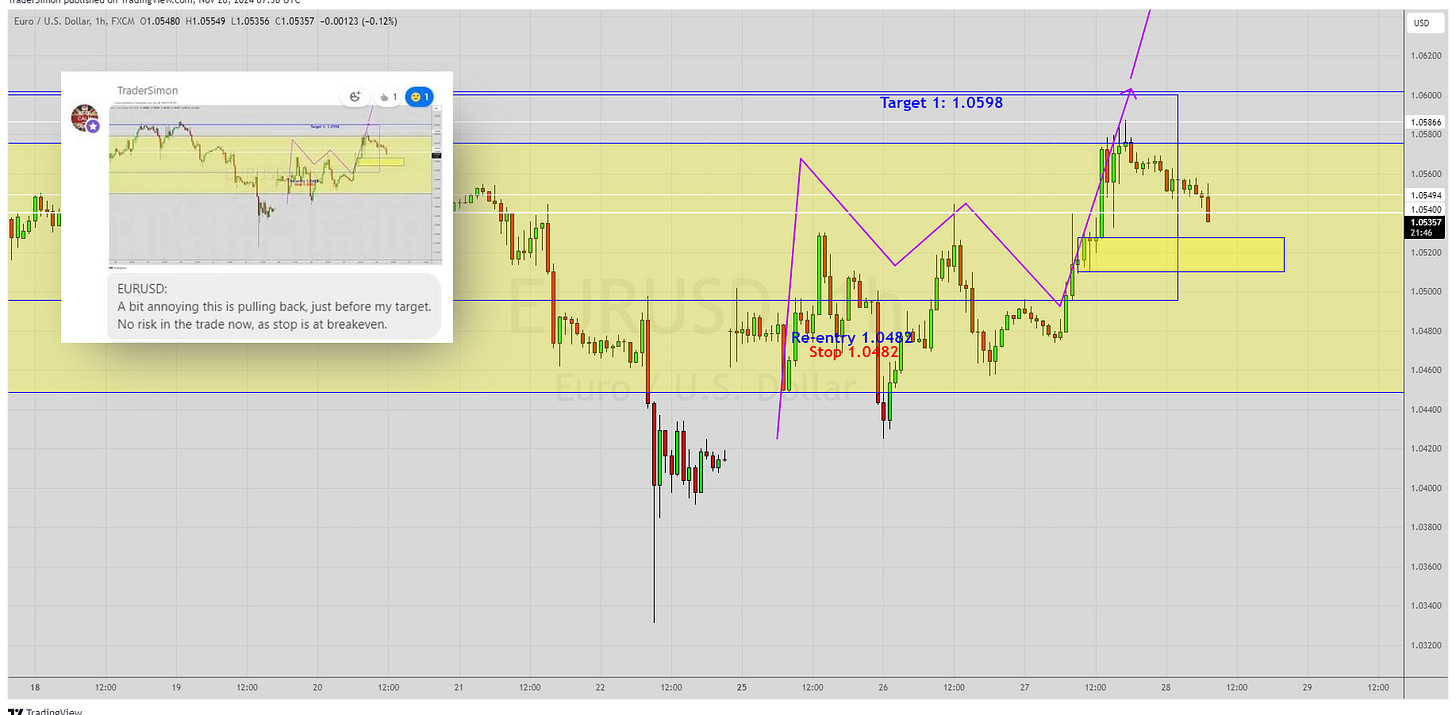

On Wednesday, we almost reached the first target, only for it to reverse to minor Demand.

Finally on Friday, price almost came back to target 1 and we scaled some profit quicker than a jewel thief in Hatton Garden.

This is often how trading is - a lot different to the “easy money” stories that some mentors portray.

We’ll see if we can make targets 2 and 3 detailed in the member’s section. Meanwhile the stoploss is now safely at breakeven.

Up next for members, we’ll analyse the Dollar Index, EUR/USD, Gold, Silver S&P 500, Bitcoin, Cardano, Chainlink and how to trade the Memecoin “LOL”.