✍️ Weekly Trade Plan & Recap 22nd - 27th December

Was Friday's recovery in Equities a dead cat bounce? Plus analysis for the DXY, EUR/USD, Gold, Silver, S&P 500, Dow Jones, Bitcoin, Cardano, Chainlink, Solana and "LOL".

Last Week

Every so often, we’ll get a losing week - that’s the very nature of trading.

The FED rate cut and FOMC Press Conference sent the Dollar flying, and as a result Equities and Cryptos dropped heavily.

That meant we took a loss on our Dollar Index short and Dow Jones long.

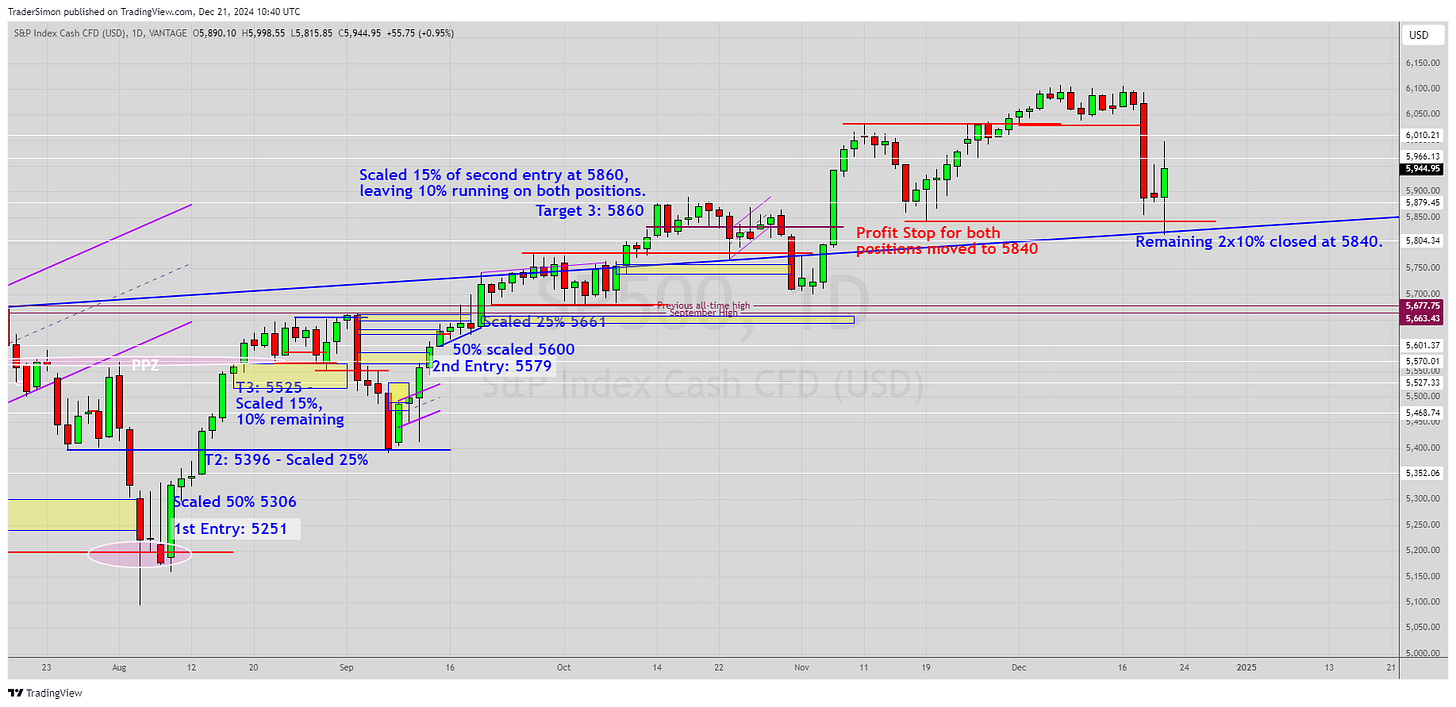

On the plus side, our scaled S&P 500 positions from 5251 and 5579 were taken out at their profit stop at 5840. We’ve had a very profitable run on these swing trades.

The daily S&P chart below show our entries and profit scales, all verifiable from previous newsletters.

Please excuse the messiness of the chart - this is a working trader’s chart!

If we look at the weekly chart, you can see the reason for the first entry - a spike rejection through a major support level. The second entry was based on similar price action on a lower timeframe.

One important point to note here: the major trendline that acted as resistance, has now become support after Friday’s dump rejected exactly at the trendline.

We’ll cover the S&P 500 later in this newsletter and I’ll explain why I’m not entirely convinced support will hold.

Next up for members, we’ll look at the Dollar Index, EUR/USD, Gold, Silver, S&P 500, Dow Jones 30, Bitcoin, Cardano, Chainlink, Solana and LOL. 👇🏼👇🏼👇🏼