✍️ Weekly Trade Plan & Recap 24th - 29th November

How we nailed profits in Gold! Plus analysis for the Dollar Index, EUR/USD, Gold, Silver, S&P 500, Bitcoin, Cardano, Chainlink and LOL.

Last Week

We had a fantastic week in Gold, with profit scaled on our latest long position from 2561.

We have just 10% left of the position running, which joins our scaled long-term positions from 1863, 1935 and 1969 - details in previous newsletters.

This is the daily chart from 16th November showing the original trade entry, at decent confluence of the channel top and Price Pivot Zone. Lower timeframe price action and structure was used to confirm the entry.

Looking at the current 4 hour chart, this is how we scaled profit along the way to the target.

Yes, we could have waited for the original target to take all profit, but I always advise to bank some along the way because we never know for sure what is going to happen!

Incidentally, leaving just a small fraction of each trade running is a great way of accumulating large long-term positions in a trend.

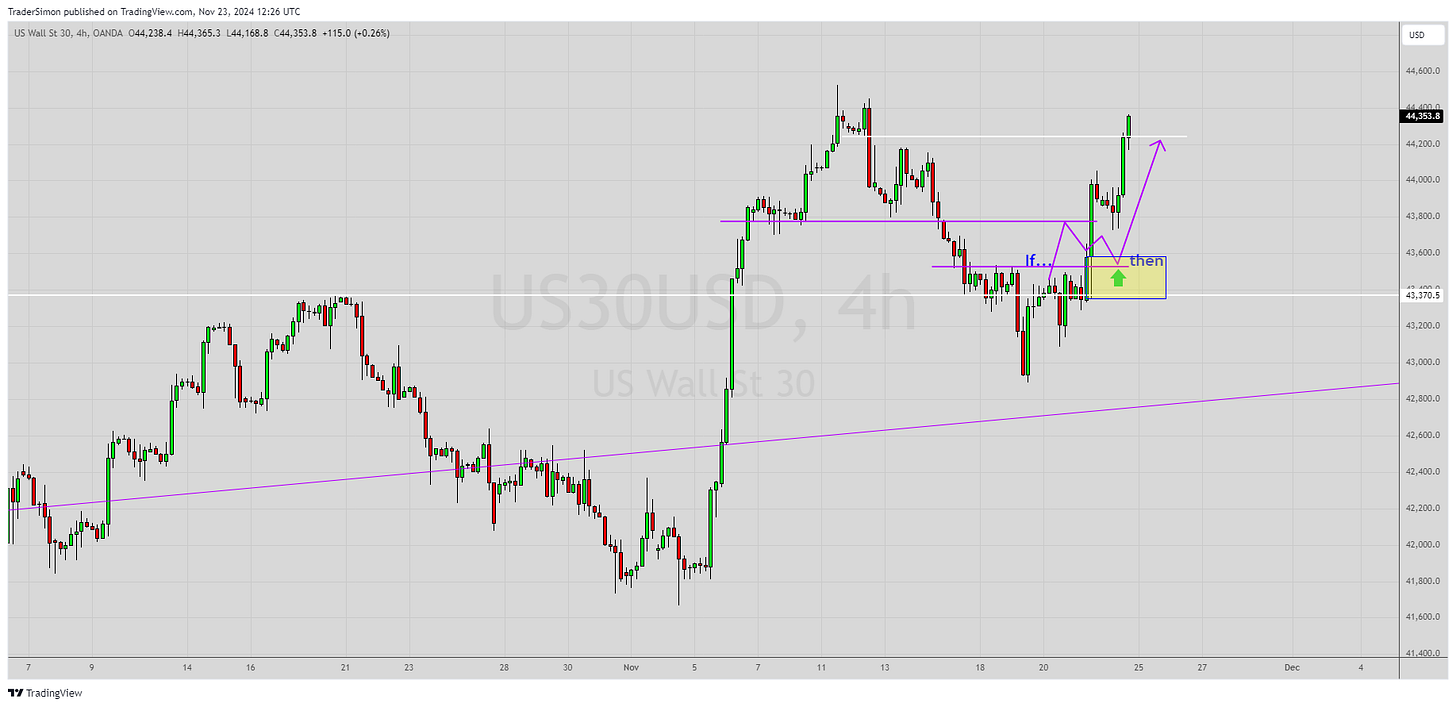

Dow Jones - the one that got away!

I like to keep it real and show that not everything goes our way…

Here’s one I published on X (as well as Substack). It was a “If.. then” setup to get long the Dow Jones on a pullback. The target was just below the high.

That one did reach target, however it didn’t pull back deep enough for an entry!

It’s a good lesson for new traders, because a missed trade can have a negative impact on a trader’s psychology.

Be annoyed for a second, but then let that feeling go. Holding on to emotions from missing a setup will lead to FOMO, late entries and even worse…. revenge trading.

Up next, for members, we’ll look at the Dollar Index, EUR/USD, Gold, Silver, S&P 500, Bitcoin, Cardano, Chainlink and the memecoin “LOL”.

If you haven’t yet joined, it’s well worth the small subscription price.